As you probably know, PCI compliance details exactly what you have to do if you plan to store, process, or transmit any cardholder data in your company. The goal of these requirements, naturally, was to protect consumers, but the reality is that PCI compliance can protect you as well. Wondering how something as simple as protecting customer data can ensure your business stays safe? Take a closer look.

Protecting Consumer Credit Card Information

Today’s world revolves around technology, and more businesses than ever need to accept credit cards in their physical locations, over the phone, and online. Because so many people are using online payment methods and more, and so many businesses are accepting it, protecting it is an absolute must, and that responsibility falls to the companies involved in collecting the credit card information. That’s how the PCI Standards evolved – credit card companies wanted to ensure breaches didn’t happen at that point of purchase, and while the standards may seem a bit strict, the reality is they’re not just there for the banks and consumers. Instead, they’re there for you, too.

How Do They Work to Protect Your Company?

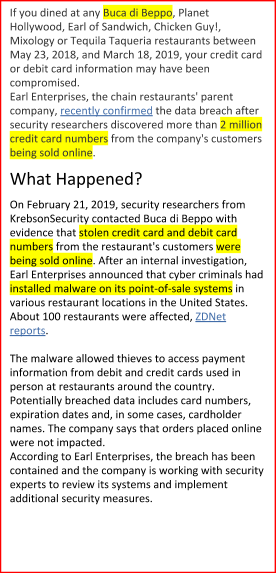

The number of identities in data breaches is only increasing. Nearly 150 million Americans have been exposed, and if you’re responsible for the next big data breach, you could have some very angry customers on your hands. Customers assume that you’ll take every precaution to help protect their information, and in the event that you don’t, you can expect to lose some business.

Digital security firm Gemalto found that 70% of customers would stop doing business with a company following a data breach. Can you imagine if 70% of your base walked away right now? That could create a serious impact when it comes to your profits. Those customers who had their data exposed in that breach could even sue you for the damages involved.

PCI standards, though, don’t just protect your business on the customer front. They also protect you from a financial standpoint. In the event that you choose not to comply with those standards, your acquiring bank can levy heavy fines against you. It’s important to note here that PCI standards are not laws. The government won’t shut your business down because you don’t comply. What will happen, though, is that your acquiring bank will fine you every single month until you address the compliance issues at hand. Those fines are not small, either. In fact, they could range from $5,000 to $100,000 on a monthly basis. If you don’t resolve the issue, you could have your ability to accept credit cards revoked, which creates the problem of fewer customers once more.

Keep in mind that data breaches don’t just affect consumers. The chances are good that your business does business online. How do you order supplies online? How do you pay for business-related services? You likely use a credit card, too, and a security breach on your vendors’ end could leave your entire company vulnerable. PCI compliance really is important, so it’s essential to understand the process.

What Does Being PCI Compliant Really Mean?

PCI compliance revolves around a number of different areas. First, you need to establish a secure network. If you’re online, and your payment system is likely tied to a computer network in some fashion, you need to ensure your system is secure. You should have the necessary protections, like an active firewall system, in place to ensure unauthorized individuals can’t access the sensitive payment information you may be storing or transmitting.

Beyond that, you need to secure your network against any threats. Information has to be limited to those who need it, so it should be encrypted at the point of transmission. Once the data is rendered useless, it must be securely destroyed.

To that end, you should implement access control measures that work for you. Restrict cardholder data to those with a unique ID who actually need to access that data.

Maintaining the security protocols you put in place is also essential. Test your networks and monitor them on a regular basis. Be sure you have policies in place that address information security as well.

A Good Payment Processor Can Help

PCI compliance protects both you and your customers, but online payment processing doesn’t have to be an overwhelming experience for your customers. Instead, choosing online payment systems built to help you maintain PCI compliance are the single best choice (and are offered at no cost) for a business of any size.

To learn more about how we can help, contact us today at 888-693-1850.